How AI is Transforming Risk Assessment in the Financial Sector

Last Updated on March 5, 2025 by Editorial Team

Author(s): Can Demir

Originally published on Towards AI.

Introduction

Risk assessment is the bedrock of finance. Banks, insurers, and investment firms have always had to identify and manage risks — be it credit defaults, market volatility, or operational hiccups. Historically, this meant painstaking manual analysis of massive datasets. But times have changed. Today, artificial intelligence (AI) is swooping in to automate, accelerate, and refine risk management like never before. According to recent studies, 68% of financial services firms name AI-driven risk management as a top priority — a telling sign that the industry is shifting toward tech-powered solutions.

So how exactly is AI transforming risk assessment? Let’s dive into the latest trends, data insights, and real-world case studies, and then explore what the future might hold.

Current Trends in AI for Risk Assessment

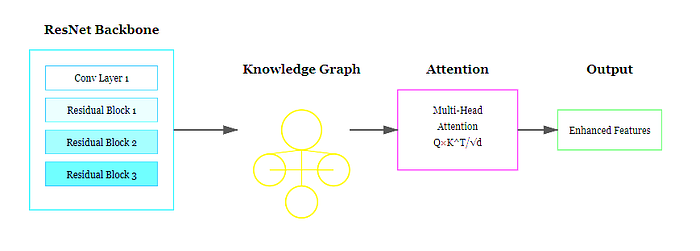

1. Machine Learning & Deep Learning

Cutting-edge algorithms can now spot complex, nonlinear relationships in data — things that traditional models would miss. For instance, AI-powered credit risk models can crunch thousands of variables, from payment history to web browsing patterns, to predict default probabilities with impressive accuracy. Similarly, fraud detection systems can identify suspicious activities in real time, reducing losses and false positives.

2. Alternative Data is Everywhere

It’s not just about your credit bureau score anymore. AI can incorporate unconventional data — from utility bills to social media signals — to build richer, more nuanced risk profiles. This approach is especially valuable for customers with minimal credit history; it opens up lending opportunities without adding undue risk.

3. Real-Time Monitoring

Thanks to big-data analytics and lightning-fast processing, banks can now detect market anomalies or cyber threats as they happen. Natural language processing (NLP) is used to scan financial filings and earnings calls for red flags, while generative AI models are emerging to automate scenario analyses and reporting.

Altogether, these trends show an industry eager to integrate AI — not just to be more efficient but to anticipate and mitigate risks before they escalate.

Data-Driven Insights

Here’s a snapshot of the industry’s readiness and results:

- Rapid Uptake: A 2024 survey indicated that 79% of financial firms believe AI is critical to the future of the sector.

- Active Implementation: In the UK, 65% of financial institutions have moved beyond the pilot stage and are actively using AI in risk management.

- Major Use Cases: Credit risk modeling and fraud detection top the charts, making up 39% of AI applications in risk management.

- Performance Gains: 90% of early adopters report that AI has already made a positive impact on their risk and compliance processes.

- Governance Gaps: Only 32% of financial institutions have formal AI governance, and even fewer have robust explainability frameworks in place.

Clearly, while AI is delivering tangible ROI — faster credit decisions, sharper fraud detection, and streamlined processes — there’s still significant ground to cover on governance and oversight.

Real-World Success Stories

Citi Bank: Corporate Credit Analysis

Citi uses AI to interpret corporate borrowers’ financial statements more quickly and reliably than a traditional analyst team, speeding up approvals and improving consistency in risk evaluations.

ZestFinance (Zest AI): Alternative Credit Scoring

By diving into non-traditional data — like utility payments or digital footprints — ZestFinance can score consumers who lack extensive credit history. This expands lending to underserved groups while still keeping defaults in check.

Upstart: AI-Powered Lending

Upstart’s model looks beyond FICO scores, incorporating factors like employment and education. The Consumer Financial Protection Bureau found their approach approved 27% more applicants while keeping interest rates fair and default rates stable.

Danske Bank: Fraud Detection

Danske Bank’s AI-driven system cut false positives by 60% and boosted true fraud detection by 50%. Fewer false alarms means investigators can focus on legitimate threats.

HSBC: Anti-Money Laundering (AML)

HSBC’s AI systems comb through millions of transactions for suspicious patterns, flagging money laundering risks more efficiently and allowing compliance teams to intervene swiftly.

From credit underwriting to AML, these examples reveal how AI is boosting accuracy, saving time, and driving better decision-making across different areas of financial risk management.

Challenges and Limitations

Despite its benefits, AI introduces unique challenges:

1. Bias and Fairness

Models trained on historical data may inadvertently reflect or even amplify existing biases. Regulators are watching this closely — discriminatory lending decisions, even if unintentional, can lead to serious legal repercussions.

2. Explainability (“Black Box” Problem)

Complex models can be tough to interpret. For regulated areas like lending or trade surveillance, understanding why a model rejects a loan application is as crucial as the decision itself.

3. Data Quality and Model Validation

“Garbage in, garbage out” still holds true. If the data is poor or outdated, AI outcomes suffer. Rigorously testing and back-testing models is essential, yet not all institutions are up to speed on these processes.

4. Regulatory Uncertainty

AI governance laws are evolving. The EU’s proposed AI Act could impose hefty fines for inadequate AI risk management. Until guidelines are crystal clear, institutions must tread carefully and establish robust internal controls.

5. Operational & Cyber Risks

AI systems need continuous oversight. They can fail catastrophically if fed malicious data or if staff blindly trust the model. Effective cybersecurity and human-in-the-loop checks are vital.

In short, institutions must build strong frameworks to keep AI reliable, transparent, and aligned with regulatory expectations.

A Look Ahead

So, what does the future hold?

- Hybrid Teams: AI will handle repetitive number crunching, while humans tackle high-level strategy, ethical dilemmas, and nuanced judgment calls.

- More Predictive Power: Future AI models will combine everything from IoT data to satellite imagery to spot risks early and help financial institutions get ahead of problems.

- Stricter Governance: Expect tighter regulations and global standards that demand transparency, accountability, and fairness in AI-driven finance.

- Improved Explainability: New methods will make AI decisions more transparent — think “why dashboards” explaining model outcomes in plain English.

- Evolving Skill Sets: Tomorrow’s risk managers will be part AI-wrangler, part data scientist, blending finance know-how with tech-savvy oversight.

Overall, AI is here to stay — and it’s reshaping risk assessment at lightning speed. Yes, navigating biases, regulations, and complexities will require diligence. But a well-implemented AI strategy can empower financial institutions to make smarter, faster decisions — and ultimately create a more inclusive and resilient global finance ecosystem.

Final Thoughts

The ongoing AI revolution in risk assessment promises more accurate predictions, proactive threat detection, and streamlined operations. Financial institutions that embrace these technologies — while investing in proper governance and upskilling their workforce — are likely to outperform their peers and contribute to a more stable financial environment. The best results will come from a balanced approach, pairing AI’s analytical power with a human touch to ensure ethical, fair, and effective risk management.

Thank you for reading! If you found this article helpful or thought-provoking, feel free to share it on social media or drop a comment below. Let’s keep the conversation going about the exciting — and sometimes challenging — intersection of AI and finance.

Disclaimer: This article is for informational purposes only and does not constitute professional financial or legal advice.

Join thousands of data leaders on the AI newsletter. Join over 80,000 subscribers and keep up to date with the latest developments in AI. From research to projects and ideas. If you are building an AI startup, an AI-related product, or a service, we invite you to consider becoming a sponsor.

Published via Towards AI

Take our 90+ lesson From Beginner to Advanced LLM Developer Certification: From choosing a project to deploying a working product this is the most comprehensive and practical LLM course out there!

Towards AI has published Building LLMs for Production—our 470+ page guide to mastering LLMs with practical projects and expert insights!

Discover Your Dream AI Career at Towards AI Jobs

Towards AI has built a jobs board tailored specifically to Machine Learning and Data Science Jobs and Skills. Our software searches for live AI jobs each hour, labels and categorises them and makes them easily searchable. Explore over 40,000 live jobs today with Towards AI Jobs!

Note: Content contains the views of the contributing authors and not Towards AI.