Transformation of the Insurance Industry by AI

Last Updated on July 24, 2023 by Editorial Team

Author(s): Rosie Harman

Originally published on Towards AI.

How is Artificial Intelligence Serving the Insurance Industry

Artificial Intelligence is probably a term so widely used these days that almost everyone is familiar with the concept, if not an expert on what it means. And rightfully so! This technology is making waves in every industry. This includes the insurance industry.

What is Artificial Intelligence?

Artificial Intelligence is a technology that enables computers to perform the same communication tasks that a human would have otherwise. Apart from communicating, computers can also perform other tasks. These include the likes of gathering information and analyzing a given set of data by running models, and eventually making a decision based on the collected data.

The increase of AI is now at a rise, and almost every other industry is making use of it in one way or another. My first encounter with an AI-powered machine was when I was comparing internet service providers for my own business setup. Upon calling Cox Business Customer service, I was surprised to realize that I was not talking to an actual human being. Now that was something!

Let’s have a look at a couple of stats that you’ll find quite interesting.

Areas to Implement AI In

The insurers are aiming at focusing on the use of Artificial Intelligence in the following areas:

- 19% of product innovation.

- 58% on customer experience.

- 43% on process optimization.

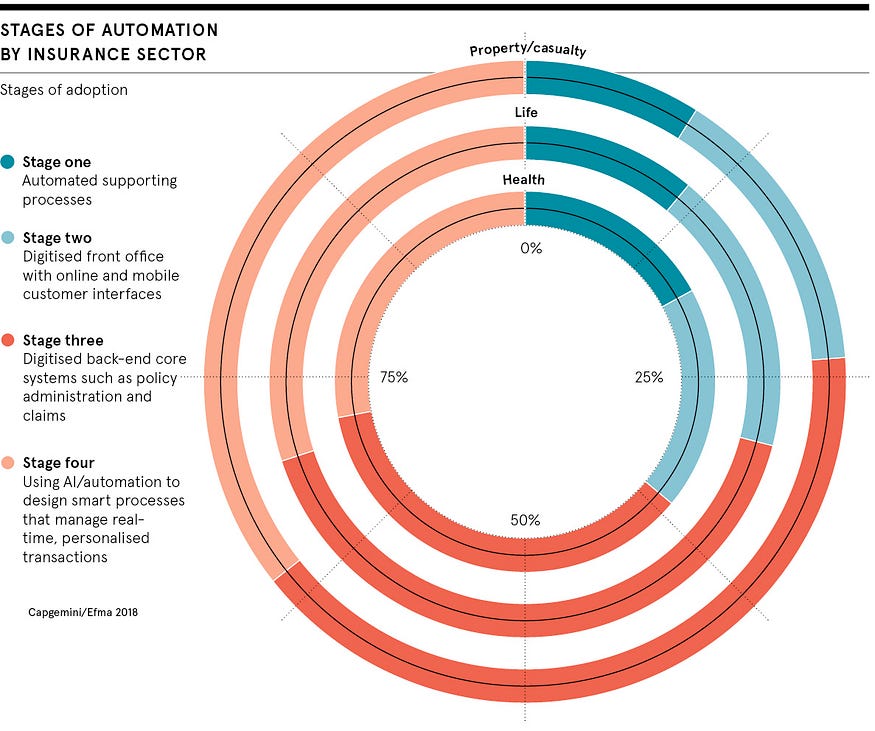

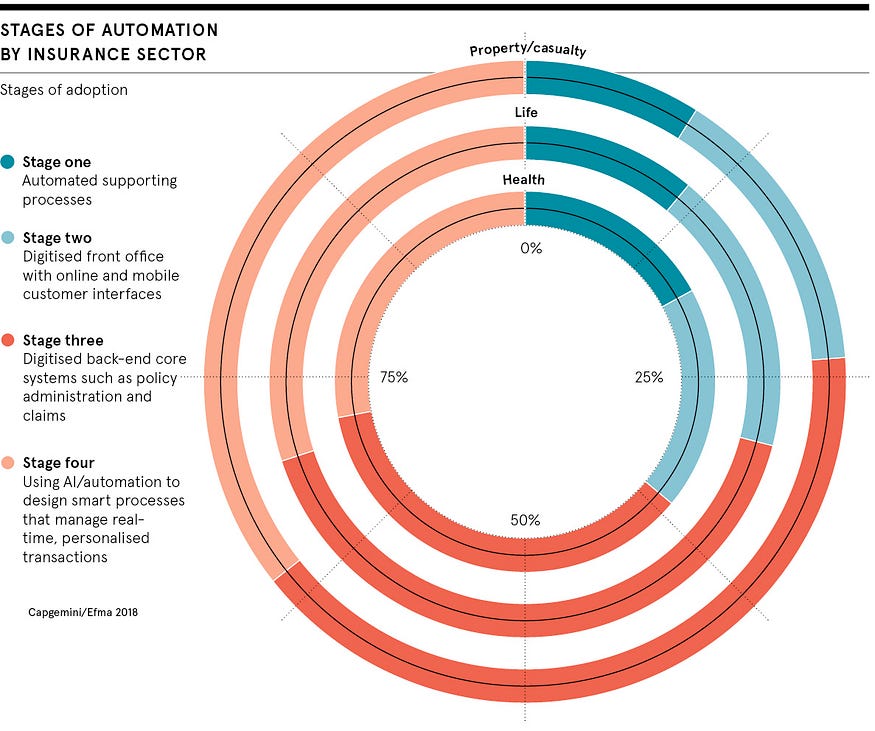

Following is a chart that will help you have a better look at the stages of automation when it comes to the Insurance industry.

Having looked at these figures, let’s now discuss the ways in which AI already is or in the future, can help the insurance industry.

Ways AI is Transforming the Insurance Industry

Facial Recognition

The insurance industry was one of the first users of the face recognition feature in various scenarios. For example, an insurance company with the name of Lapetus already makes use of the face recognition feature to buy life insurance by clicking a selfie.

You might not be able to make sense out of it. But the face recognition technology allows the companies to dig deeper into a person’s habits like smoking. Therefore, enabling the companies to design a life insurance plan accordingly. This saves individuals from going through expensive medical tests.

Machine Learning

The insurance industry is already making extensive use of chatbots. Chatbots allow these companies to build up the initial conversations with the clients. This, in turn, helps the companies to reduce operational costs. The chatbots help to converse with the customers. This is the type of conversation that chatbots can quickly build and respond to, as well.

Personalization

The times when customers only had a limited number of insurance plans to choose from is probably coming to an end. Because AI allows the companies to customize the plans according to each individual and his habits. The modern-day insurance is all about customization and customer experience. The more customized a plan is, the more satisfied will the customer be.

In fact, some companies are already providing their customers with the opportunity to build their own insurance plans on their websites.

Claims Settled Fast

AI also enables the insurance companies to settle the customers’ claims fast as well. Because one of the primary abilities that an insurance company is judged upon is its ability to settle the claims fast enough. If it fails to do so, it loses clientele.

This is because the machines are much faster and efficient than human beings will ever be. Hence, allowing insurance companies to please their clients.

Behavioral Premium Pricing

One of the most innovative technologies in the world of insurance is the wearable sensors that collect information about customers. An example is the installation of such devices in the cars to help them gather information regarding the way a driver is driving.

This, in turn, can help the insurer to come up with an insurance offer for the person concerned.

Currently, financial models are built based on statistics. This means that the companies study a client’s past record and build predictions based on that. However, this new approach allows companies to have access to real-time information. This means that it is possible to customize the insurance premium according to the behavior of an individual.

Join thousands of data leaders on the AI newsletter. Join over 80,000 subscribers and keep up to date with the latest developments in AI. From research to projects and ideas. If you are building an AI startup, an AI-related product, or a service, we invite you to consider becoming a sponsor.

Published via Towards AI

Take our 90+ lesson From Beginner to Advanced LLM Developer Certification: From choosing a project to deploying a working product this is the most comprehensive and practical LLM course out there!

Towards AI has published Building LLMs for Production—our 470+ page guide to mastering LLMs with practical projects and expert insights!

Discover Your Dream AI Career at Towards AI Jobs

Towards AI has built a jobs board tailored specifically to Machine Learning and Data Science Jobs and Skills. Our software searches for live AI jobs each hour, labels and categorises them and makes them easily searchable. Explore over 40,000 live jobs today with Towards AI Jobs!

Note: Content contains the views of the contributing authors and not Towards AI.