Unveiling the Future: Mastering Stock Market Prediction with PMDARIMA

Last Updated on May 7, 2024 by Editorial Team

Author(s): Himanshu Sharma

Originally published on Towards AI.

Unlock the Secrets of Stock Market Forecasting with Python’s PMDARIMA Library

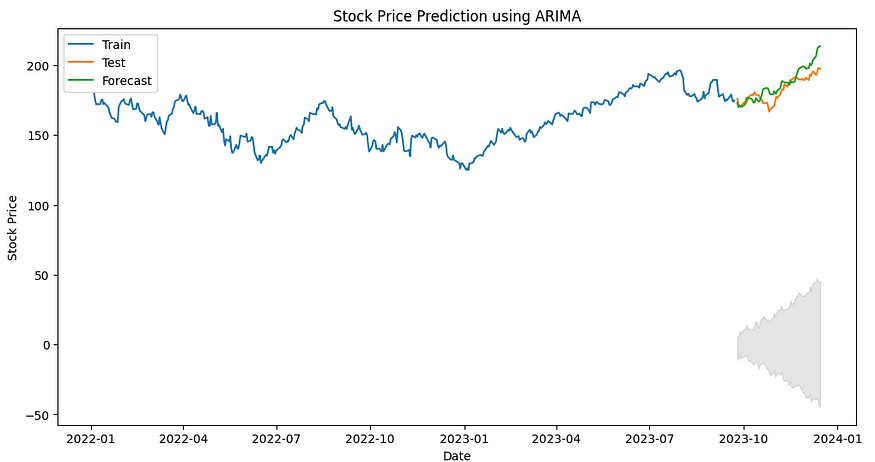

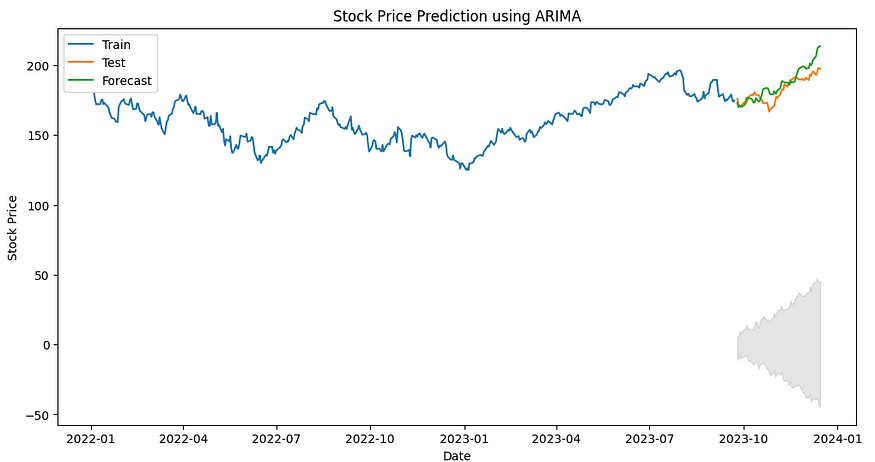

Stock Prediction(Source: By Author)

Predicting stock market prices is a challenging yet crucial task for investors and financial analysts. The ability to forecast future price movements helps in making informed investment decisions and mitigating risks. In recent years, with the advent of advanced machine learning techniques, Python libraries like PMDARIMA have gained popularity for their effectiveness in time series analysis and forecasting.

PMDARIMA, or “Auto-ARIMA,” is a Python library that automates the process of selecting optimal parameters for the ARIMA model, a widely used method for time series forecasting. ARIMA stands for AutoRegressive Integrated Moving Average and is particularly suited for analyzing and predicting time-dependent data, such as stock prices.

PMDARIMA simplifies the task of building ARIMA models by automatically determining the optimal values for parameters like p, d, and q, which represent the auto-regressive, differencing, and moving average components, respectively. This automation significantly reduces the manual effort required to tune these parameters, making the modeling process more efficient and accessible to users.

Getting started with PMDARIMA is easy. You can install the library using pip, the Python package manager, and Yfinance for downloading stock data by running the following command:

pip install pmdarimapip install yfinance

Once installed, you can import the necessary modules in your… Read the full blog for free on Medium.

Join thousands of data leaders on the AI newsletter. Join over 80,000 subscribers and keep up to date with the latest developments in AI. From research to projects and ideas. If you are building an AI startup, an AI-related product, or a service, we invite you to consider becoming a sponsor.

Published via Towards AI

Take our 90+ lesson From Beginner to Advanced LLM Developer Certification: From choosing a project to deploying a working product this is the most comprehensive and practical LLM course out there!

Towards AI has published Building LLMs for Production—our 470+ page guide to mastering LLMs with practical projects and expert insights!

Discover Your Dream AI Career at Towards AI Jobs

Towards AI has built a jobs board tailored specifically to Machine Learning and Data Science Jobs and Skills. Our software searches for live AI jobs each hour, labels and categorises them and makes them easily searchable. Explore over 40,000 live jobs today with Towards AI Jobs!

Note: Content contains the views of the contributing authors and not Towards AI.