Step-By-Step Machine Learning Project in Python — Credit Card Fraud Detection

Last Updated on July 25, 2023 by Editorial Team

Author(s): Fares Sayah

Originally published on Towards AI.

Demonstration of How to Handle Highly Imbalanced Classification Problems

What is Credit Card Fraud?

Credit card fraud occurs when an individual uses someone else’s credit card or account information without permission to make unauthorized purchases or withdraw funds through cash advances. It can happen both online and in physical stores. As a business owner, you can protect yourself from potential headaches and negative publicity by being vigilant and identifying instances of fraudulent credit card usage in your payment system.

Three challenges surrounding Credit Card Fraud

- It’s not always easy to agree on the ground truth of what “fraud” means.

- Regardless of how you define ground truth, the vast majority of charges are not fraudulent.

- Most merchants aren’t experts at evaluating the business impact of fraud.

Problem Statement:

The objective of Credit Card Fraud Detection is to accurately identify fraudulent transactions from a large pool of credit card transactions by building a predictive model based on past transaction data. The aim is to detect all fraudulent transactions with minimum false alarms.

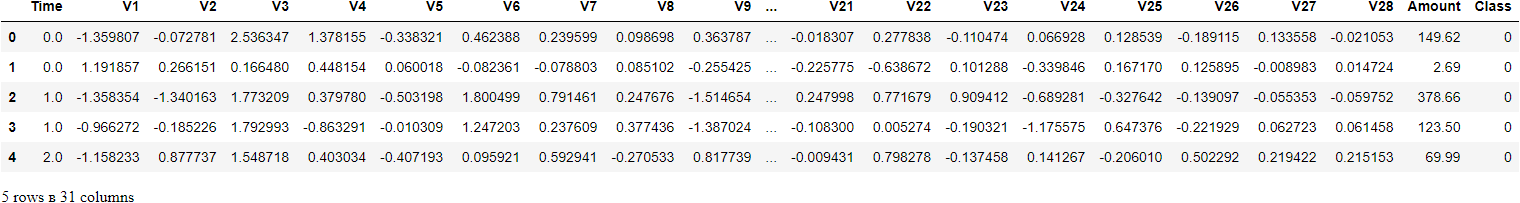

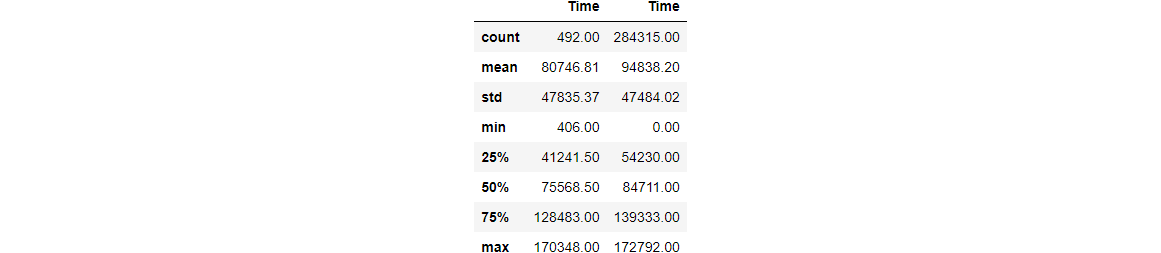

Observations

- The dataset is highly imbalanced, with only 0.172% of observations being fraudulent.

- The dataset consists of 28 transformed features (V1 to V28) and two untransformed features (Time and Amount).

- There is no missing data in the dataset, and no information about the original features is provided.

Why does class imbalance affect model performance?

- In general, we want to maximize the recall while capping FPR (False Positive Rate), but you can classify a lot of charges wrong and still maintain a low FPR because you have a large number of true negatives.

- This is conducive to picking a relatively low threshold, which results in a high recall but extremely low precision.

What is the catch?

- Training a model on a balanced dataset optimizes performance on validation data.

- However, the goal is to optimize performance on the imbalanced production dataset. You ultimately need to find a balance that works best in production.

- One solution to this problem is: Use all fraudulent transactions but subsample non-fraudulent transactions as needed to hit our target rate.

Business questions to brainstorm:

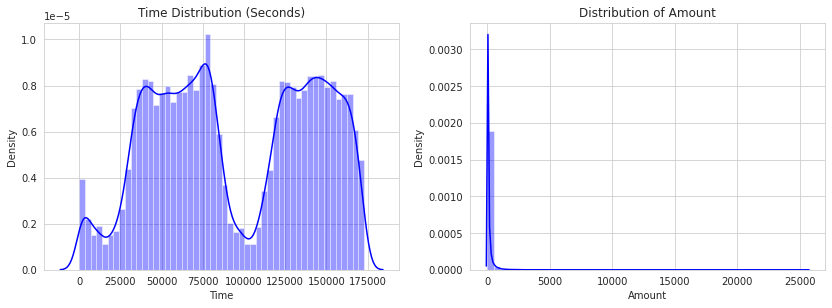

Since all features are anonymous, we will focus our analysis on non-anonymized features: Time, Amount

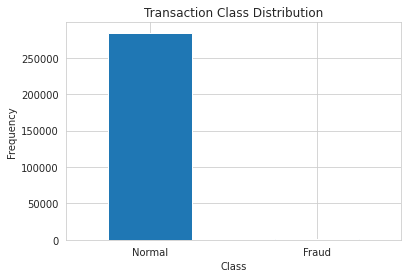

- How different is the amount of money used in different transaction classes?

- Do fraudulent transactions occur more often during certain frames?

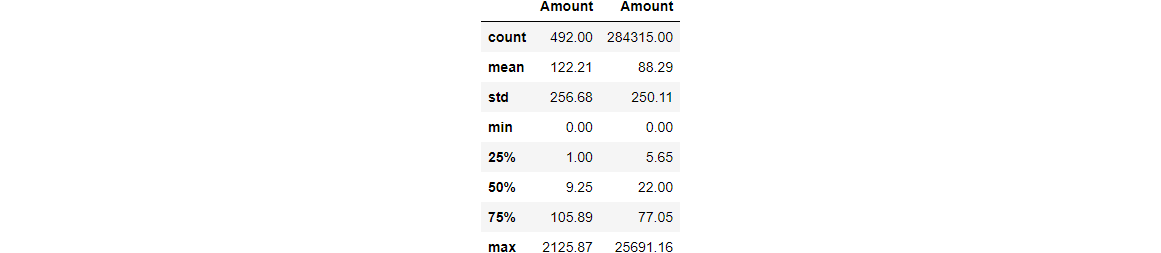

Exploratory Data Analysis — EDA

Let us now check the missing values in the dataset.

0

The only non-transformed variables to work with are:

TimeAmountClass(1: fraud, 0: not_fraud)

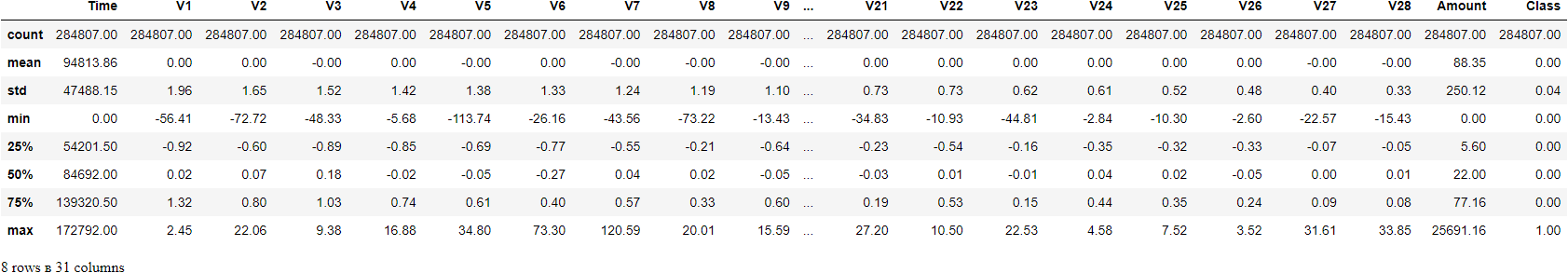

0 284315

1 492

Name: Class, dtype: int64

Notice how imbalanced is our original dataset! Most of the transactions are non-fraud. If we use this DataFrame as the base for our predictive models and analysis, we might get a lot of errors, and our algorithms will probably overfit since they will “assume” that most transactions are not a fraud. But we don’t want our model to assume, we want our model to detect patterns that give signs of fraud!

Determine the number of fraud and valid transactions in the entire dataset.

Shape of Fraudulant transactions: (492, 31)

Shape of Non-Fraudulant transactions: (284315, 31)

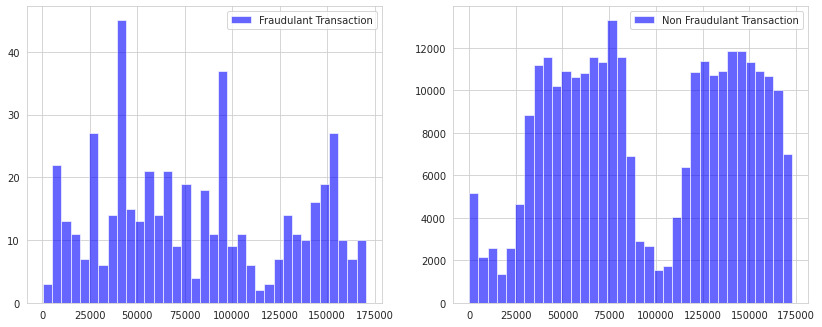

How different is the amount of money used in different transaction classes?

Do fraudulent transactions occur more often during a certain time frame?

Distributions:

By seeing the distributions, we can have an idea of how skewed these features are, and we can also see further distributions of the other features. There are techniques that can help the distributions be less skewed, which will be implemented in this notebook in the future.

Doesn’t seem like the time of the transaction really matters here, as per the above observation. Now let us take a sample of the dataset for our modeling and prediction.

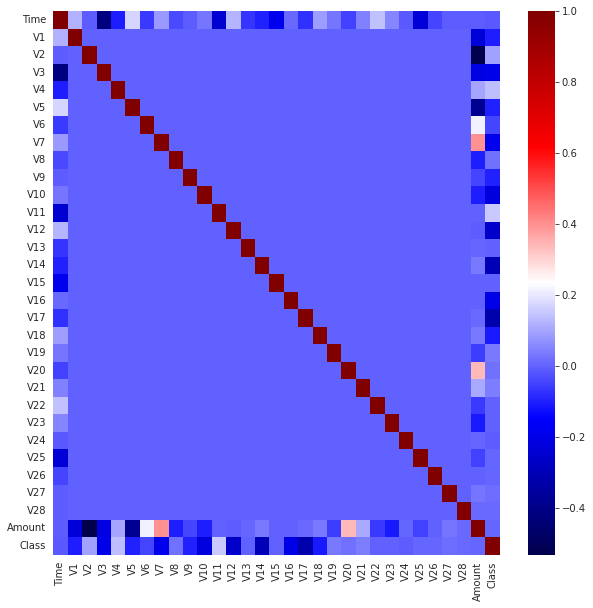

Correlation Matrices

Correlation matrices are the essence of understanding our data. We want to know if there are features that influence heavily whether a specific transaction is a fraud. However, it is important that we use the correct DataFrame (subsample) in order for us to see which features have a high positive or negative correlation with regard to fraudulent transactions.

Summary and Explanation:

- Negative Correlations: V17, V14, V12, and V10 are negatively correlated. Notice how the lower these values are, the more likely the end result will be a fraudulent transaction.

- Positive Correlations: V2, V4, V11, and V19 are positively correlated. Notice how the higher these values are, the more likely the end result will be a fraudulent transaction.

- BoxPlots: We will use boxplots to have a better understanding of the distribution of these features in fraudulent and non-fraudulent transactions.

Note: We have to make sure we use the subsample in our correlation matrix or else our correlation matrix will be affected by the high imbalance between our classes. This occurs due to the high-class imbalance in the original DataFrame.

The highest correlations come from:

- Time & V3 (-0.42)

- Amount & V2 (-0.53)

- Amount & V4 (0.4)

Data Pre-processing

Time and Amount should be scaled as the other columns.

Fraudulant transaction weight: 0.0017994745785028623

Non-Fraudulant transaction weight: 0.9982005254214972

TRAINING: X_train: (159491, 30), y_train: (159491,)

_______________________________________________________

VALIDATION: X_validate: (39873, 30), y_validate: (39873,)

__________________________________________________

TESTING: X_test: (85443, 30), y_test: (85443,)

Model Building

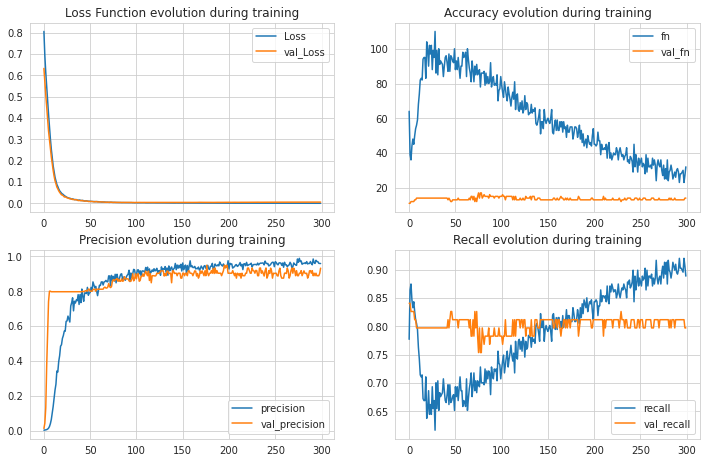

Artificial Neural Networks (ANNs)

2671/2671 [==============================] - 11s 4ms/step - loss: 0.0037 - fn: 29.0000 - fp: 12.0000 - tn: 85295.0000 - tp: 107.0000 - precision: 0.8992 - recall: 0.7868

[0.003686850192025304, 29.0, 12.0, 85295.0, 107.0, 0.8991596698760986, 0.7867646813392639]

Train Result:

================================================

Accuracy Score: 99.99%

_______________________________________________

Classification Report:

0 1 accuracy macro avg weighted avg

precision 1.00 1.00 1.00 1.00 1.00

recall 1.00 0.95 1.00 0.98 1.00

f1-score 1.00 0.97 1.00 0.99 1.00

support 159204.00 287.00 1.00 159491.00 159491.00

_______________________________________________

Confusion Matrix:

[[159204 0]

[ 14 273]]

Test Result:

================================================

Accuracy Score: 99.96%

_______________________________________________

Classification Report:

0 1 accuracy macro avg weighted avg

precision 1.00 0.92 1.00 0.96 1.00

recall 1.00 0.81 1.00 0.90 1.00

f1-score 1.00 0.86 1.00 0.93 1.00

support 85307.00 136.00 1.00 85443.00 85443.00

_______________________________________________

Confusion Matrix:

[[85298 9]

[ 26 110]]

XGBoost

Train Result:

================================================

Accuracy Score: 100.00%

_______________________________________________

Classification Report:

0 1 accuracy macro avg weighted avg

precision 1.00 1.00 1.00 1.00 1.00

recall 1.00 1.00 1.00 1.00 1.00

f1-score 1.00 1.00 1.00 1.00 1.00

support 159204.00 287.00 1.00 159491.00 159491.00

_______________________________________________

Confusion Matrix:

[[159204 0]

[ 0 287]]

Test Result:

================================================

Accuracy Score: 99.96%

_______________________________________________

Classification Report:

0 1 accuracy macro avg weighted avg

precision 1.00 0.95 1.00 0.97 1.00

recall 1.00 0.82 1.00 0.91 1.00

f1-score 1.00 0.88 1.00 0.94 1.00

support 85307.00 136.00 1.00 85443.00 85443.00

_______________________________________________

Confusion Matrix:

[[85301 6]

[ 25 111]]

Random Forest

Train Result:

================================================

Accuracy Score: 100.00%

_______________________________________________

Classification Report:

0 1 accuracy macro avg weighted avg

precision 1.00 1.00 1.00 1.00 1.00

recall 1.00 1.00 1.00 1.00 1.00

f1-score 1.00 1.00 1.00 1.00 1.00

support 159204.00 287.00 1.00 159491.00 159491.00

_______________________________________________

Confusion Matrix:

[[159204 0]

[ 0 287]]

Test Result:

================================================

Accuracy Score: 99.96%

_______________________________________________

Classification Report:

0 1 accuracy macro avg weighted avg

precision 1.00 0.91 1.00 0.95 1.00

recall 1.00 0.82 1.00 0.91 1.00

f1-score 1.00 0.86 1.00 0.93 1.00

support 85307.00 136.00 1.00 85443.00 85443.00

_______________________________________________

Confusion Matrix:

[[85296 11]

[ 25 111]]

CatBoost

Train Result:

================================================

Accuracy Score: 100.00%

_______________________________________________

Classification Report:

0 1 accuracy macro avg weighted avg

precision 1.00 1.00 1.00 1.00 1.00

recall 1.00 1.00 1.00 1.00 1.00

f1-score 1.00 1.00 1.00 1.00 1.00

support 159204.00 287.00 1.00 159491.00 159491.00

_______________________________________________

Confusion Matrix:

[[159204 0]

[ 1 286]]

Test Result:

================================================

Accuracy Score: 99.96%

_______________________________________________

Classification Report:

0 1 accuracy macro avg weighted avg

precision 1.00 0.93 1.00 0.97 1.00

recall 1.00 0.82 1.00 0.91 1.00

f1-score 1.00 0.87 1.00 0.94 1.00

support 85307.00 136.00 1.00 85443.00 85443.00

_______________________________________________

Confusion Matrix:

[[85299 8]

[ 25 111]]

LigthGBM

Train Result:

================================================

Accuracy Score: 99.58%

_______________________________________________

Classification Report:

0 1 accuracy macro avg weighted avg

precision 1.00 0.23 1.00 0.62 1.00

recall 1.00 0.59 1.00 0.79 1.00

f1-score 1.00 0.33 1.00 0.67 1.00

support 159204.00 287.00 1.00 159491.00 159491.00

_______________________________________________

Confusion Matrix:

[[158652 552]

[ 119 168]]

Test Result:

================================================

Accuracy Score: 99.50%

_______________________________________________

Classification Report:

0 1 accuracy macro avg weighted avg

precision 1.00 0.16 0.99 0.58 1.00

recall 1.00 0.53 0.99 0.76 0.99

f1-score 1.00 0.25 0.99 0.62 1.00

support 85307.00 136.00 0.99 85443.00 85443.00

_______________________________________________

Confusion Matrix:

[[84942 365]

[ 64 72]]

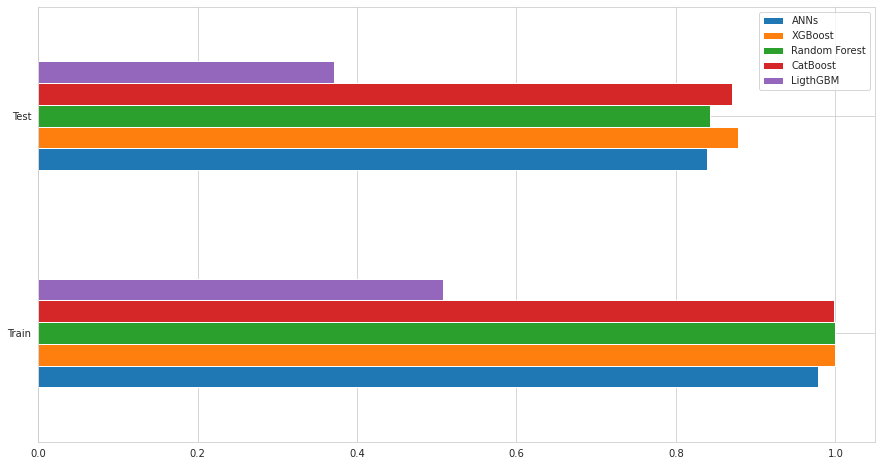

Model Comparison

Conclusions:

We learned how to develop our credit card fraud detection model using machine learning. We used a variety of ML algorithms, including ANNs and Tree-based models. At the end of the training, out of 85443 validation transaction, XGBoost performs better than other models:

- Correctly identifying

111of them as fraudulent - Missing

9fraudulent transactions - At the cost of incorrectly flagging

25legitimate transactions

Links and Resources:

- Link to data used in this tutorial: Credit Card Fraud Detection

- Link to Full Notebook

Join thousands of data leaders on the AI newsletter. Join over 80,000 subscribers and keep up to date with the latest developments in AI. From research to projects and ideas. If you are building an AI startup, an AI-related product, or a service, we invite you to consider becoming a sponsor.

Published via Towards AI

Take our 90+ lesson From Beginner to Advanced LLM Developer Certification: From choosing a project to deploying a working product this is the most comprehensive and practical LLM course out there!

Towards AI has published Building LLMs for Production—our 470+ page guide to mastering LLMs with practical projects and expert insights!

Discover Your Dream AI Career at Towards AI Jobs

Towards AI has built a jobs board tailored specifically to Machine Learning and Data Science Jobs and Skills. Our software searches for live AI jobs each hour, labels and categorises them and makes them easily searchable. Explore over 40,000 live jobs today with Towards AI Jobs!

Note: Content contains the views of the contributing authors and not Towards AI.