Linearity Bias

Last Updated on January 27, 2021 by Editorial Team

Author(s): Nithin Raj Anantha

Data Science

What is Linear Bias and why is it prominent in our day-to-day lives?

Consider this, you are very hungry and plan to order pizza, you have two options right in front of you: One 18-inch pizza or two 12-inch pizzas, which one would you rather order to get more quantity? If you grabbed two 12-inch pizzas over the 18-inch pizza then you got it all wrong my friend..!!

If you think about it the area of an 18-inch pizza is 254in² and two 12-inch pizzas would be 226in². See not even close, then why do we tend to think this way? — The answer is Linearity Bias.

What is linearity bias?

Every day consciously or unconsciously humans, organizations, and governments are trying to make sense of the world. We try to figure out how and why the events occur and how are they influenced by the decisions we make. The way we tend to do this is by thinking in linear terms which we approach by following through certain patterns of predictability and consistency.

Human brains are deceptive mostly because of the different biases that our brain produces, and decades of research has also shown that the human mind struggles to understand nonlinear relationships. Our mind always tends to think in straight lines and apparently in many situations, it makes sense: If the price of a drink is $5, you could get 5 of them for $25, 10 for $50, and 15 for $75.

But most of the time we fail to account for situations like these:

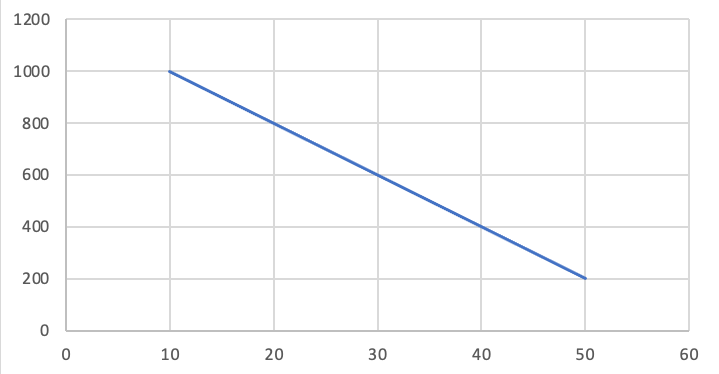

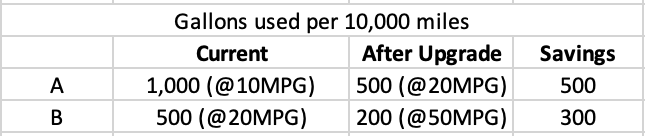

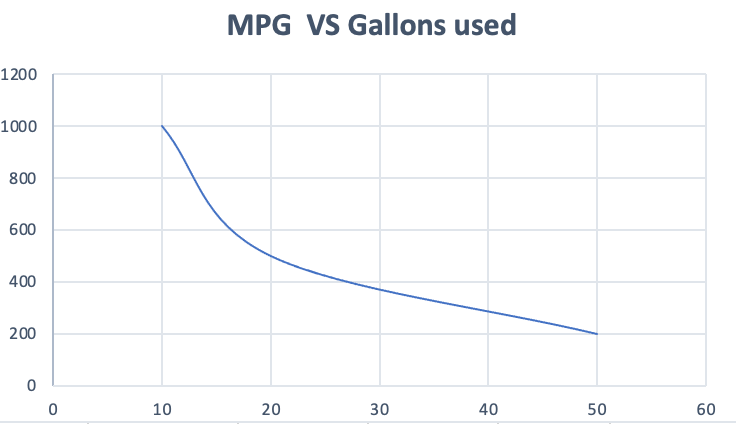

Consider you own two cars; A gives you 10 miles per gallon and B gives you 20. You have decided to replace one of them with a more fuel-efficient option. You have two options:

A) 10 MPG with 20MPG

B) 20 MPG with 50MPG

Intuitively option B seems a better choice as an increase in 30 MPG is a lot larger than a 10 MPG one as we assume the relationship to be something like:

But instead it looks something like this and option A is killing it..!!!

In fact, it is shocking to see that upgrading fuel efficiency from 20 to 100 MPG still wouldn’t save as much as upgrading from 10 to 20 MPG.

Business Problem:

We live in a world where important business decisions are intertwined with non-linear relationships that we need to account for when they’re in play. There are numerous scenarios where consumers and companies have fallen victim to linear bias because linearity is an assumption of convenience and it is deceptively familiar. Even the experts who are aware of nonlinearity have failed to take it into account by relying on their gut.

Profit is one of the common concerns in a business objective, and there are three main factors that affect profits: costs, volume, and price. When one factor is altered others need to be changed as well to maintain the profits.

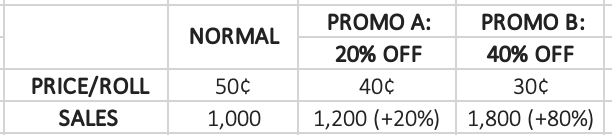

Imagine you are managing a brand of paper towels. Usually, they sell for 50 cents a roll and the cost of producing them is 15 cents. Now you decided on two types of price promotions and here are the results:

Wow!! promotion B yielded us an 80% increase in sales for just 40% decrease in price, but as you might have guessed by now that if we dig deeper we would understand that B is not the most profitable strategy.

We can see that by reducing the price by 40% the profit reduced by 25%, so to maintain the profit of $350 we need to sell more than 2300 units of paper towels (an increase of 133%).

Consumers:

There are numerous instances where the companies have taken advantage of consumers’ tendency to assume that the relationship between attributes and benefits is linear. According to research done by Harvard Business School show that internet connections are priced linearly, whereas the relationship between the download speed and download time is non-linear. Upgrading from 5 to 25mbps will save you 21 minutes per GB while an increase from 25 to 100mbps reduces only 4 minutes. I bet you are now thinking about changing your data plan 😉.

There it is! Now you know how we have been falling prey to linear bias, we need to understand that it is important to focus on the outcomes rather than the indicators to make wise decisions by avoiding its trap. Data-Driven decision-making has exploded in recent years and we can see why that is.

Thank you for taking the time and reading this article. Do share your thoughts regarding this!! Until next time, Bye.

Peace ✌️

References:

Langhe, Bart De, et al. “Linear Thinking in a Nonlinear World.” Harvard Business Review, 16 Dec. 2020, hbr.org/2017/05/linear-thinking-in-a-nonlinear-world.

Goodrum, Will. “Simple, Attractive, and Wrong: An Introduction to Linearity Bias.” Elder Research, 11 Nov. 2020, www.elderresearch.com/blog/simple-attractive-and-wrong-an-introduction-to-linearity-bias/.

Magourilos, Frank G. “The Big Picture View: Linear Thinking in a Nonlinear World.” RSS, www.corporatewellnessmagazine.com/article/big-picture-view-linear-thinking-nonlinear-world.

Mester, Tomi. “Statistical Bias Types Explained (with Examples) — part1.” Data36, 22 July 2020, data36.com/statistical-bias-types-explained/.

Linearity Bias was originally published in Towards AI on Medium, where people are continuing the conversation by highlighting and responding to this story.

Published via Towards AI

Take our 90+ lesson From Beginner to Advanced LLM Developer Certification: From choosing a project to deploying a working product this is the most comprehensive and practical LLM course out there!

Towards AI has published Building LLMs for Production—our 470+ page guide to mastering LLMs with practical projects and expert insights!

Discover Your Dream AI Career at Towards AI Jobs

Towards AI has built a jobs board tailored specifically to Machine Learning and Data Science Jobs and Skills. Our software searches for live AI jobs each hour, labels and categorises them and makes them easily searchable. Explore over 40,000 live jobs today with Towards AI Jobs!

Note: Content contains the views of the contributing authors and not Towards AI.