Machine Learning Model for Stochastic Processes

Last Updated on July 25, 2023 by Editorial Team

Author(s): Benjamin Obi Tayo Ph.D.

Originally published on Towards AI.

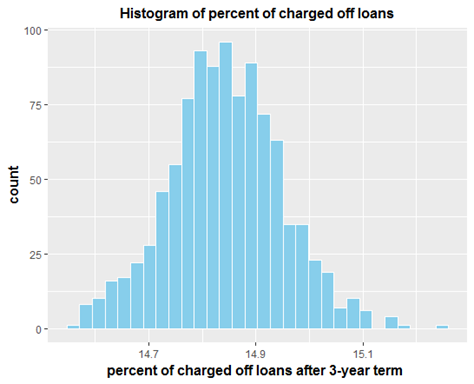

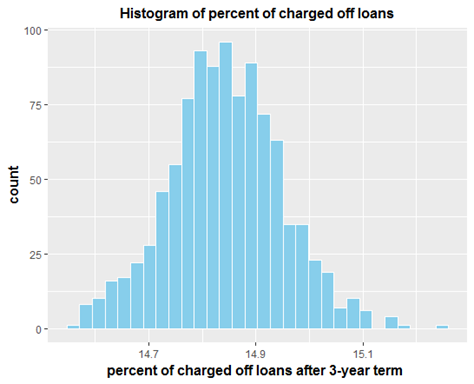

Abstract: Using the loan_timing.csv dataset provided, we built a simple model using the Monte Carlo simulation for predicting the fraction of loans that will default after the 3-year duration of the loan. Our model revealed a 95% confidence interval of 14.8% +/- 0.2% for Monte-Carlo simulation of N = 1000 replicated copies of the dataset. Based on these analyses, if 50,000 loans were given out with a loan term of 3 years, approximately 15% of these loans will default during the loan term.

Introduction: Predicting the status of a loan is an important problem in risk assessment. A bank or financial… Read the full blog for free on Medium.

Join thousands of data leaders on the AI newsletter. Join over 80,000 subscribers and keep up to date with the latest developments in AI. From research to projects and ideas. If you are building an AI startup, an AI-related product, or a service, we invite you to consider becoming a sponsor.

Published via Towards AI

Take our 90+ lesson From Beginner to Advanced LLM Developer Certification: From choosing a project to deploying a working product this is the most comprehensive and practical LLM course out there!

Towards AI has published Building LLMs for Production—our 470+ page guide to mastering LLMs with practical projects and expert insights!

Discover Your Dream AI Career at Towards AI Jobs

Towards AI has built a jobs board tailored specifically to Machine Learning and Data Science Jobs and Skills. Our software searches for live AI jobs each hour, labels and categorises them and makes them easily searchable. Explore over 40,000 live jobs today with Towards AI Jobs!

Note: Content contains the views of the contributing authors and not Towards AI.