Credit Default Modelling Using Decision Trees

Last Updated on July 26, 2023 by Editorial Team

Author(s): Jatindeep Singh

Originally published on Towards AI.

Detecting Credit Worthiness using Tree-based techniques

Machine Learning Algorithms have historically been used in the Credit and Fraud Space. With the increase in computational power, the Industry has made a move from Tree-based Logit models to more advanced Machine Learning Techniques involving Bagging and Boosting. industry. The article is designed to provide the readers with a Mathematical View of Decision Trees, Bagging, and Random Forest Algorithms. In the final section, the writer discusses how to use these techniques for Credit Default and Fraud Prevention using Data from LendingClub.

Decision Trees

1. Introduction

The basic intuition behind decision trees is to map out all possible decision paths in the form of a binary tree. Showcasing the same with the example of identifying flower type(y) using the ratio of sepal length to width(x1) and the ratio of petal length to width(x2)

The initial split at x1>1.7 helps in identifying flower type y=1

The next node split at x2>2.8 helps identify y=2 and y=3

Mathematically, a Decision Tree maps inputs x ∈ R^d to output y using binary decision rules:

Each node in the tree has a splitting Rule

- Splitting based on top-down Greedy Algorithm

- Each Leaf Node is associated with an output value

Each splitting rule is of the form

- h(x) = 1{xj > t}

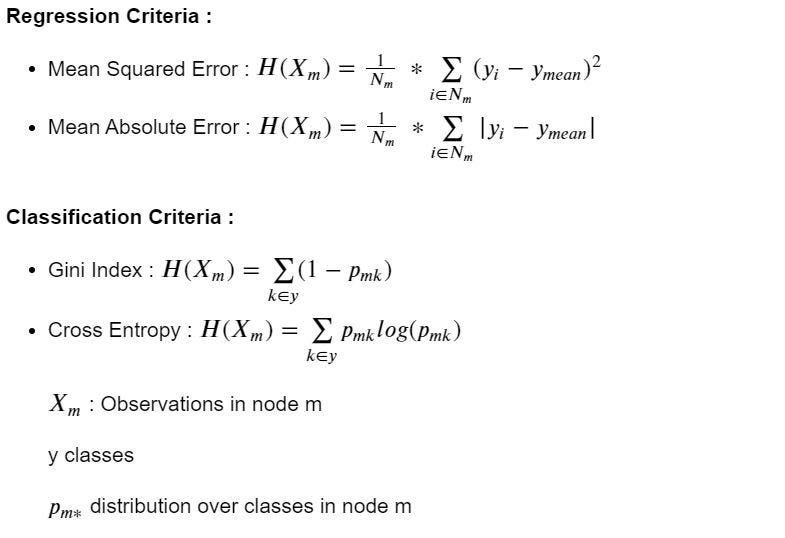

2. Splitting Criteria

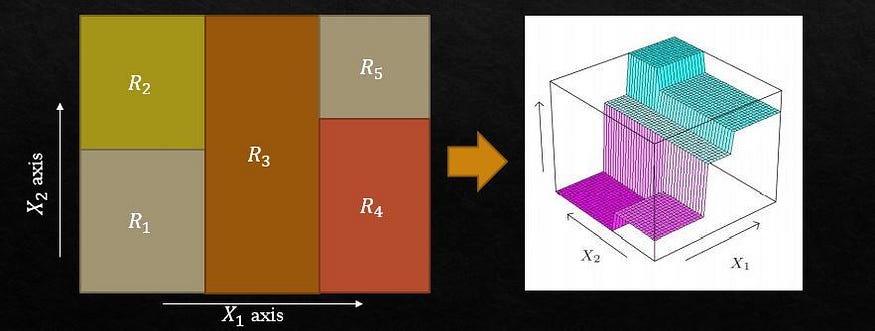

3. Geometrical View

Motivation :

- Partition the space so that data in a region have the same prediction

- Each partition represents a vertical or horizontal line in the 2-D plane

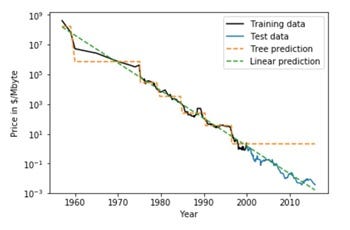

4. Challenges

- Decision Trees cannot Extrapolate

- High Variance or Instability to change in data: By minor change in data we see the variation in the Structure of the Decision Tree

- The reason for the High Variance in decision trees lies in the fact that they are based on a Greedy Algorithm. It focuses on optimizing for the node split at hand, rather than taking into account how that split impacts the entire tree. A greedy approach makes Decision Trees run faster but makes them prone to overfitting.

In the next sections, we will discuss how to overcome these challenges

Bootstrap Aggregator

1. Motivation

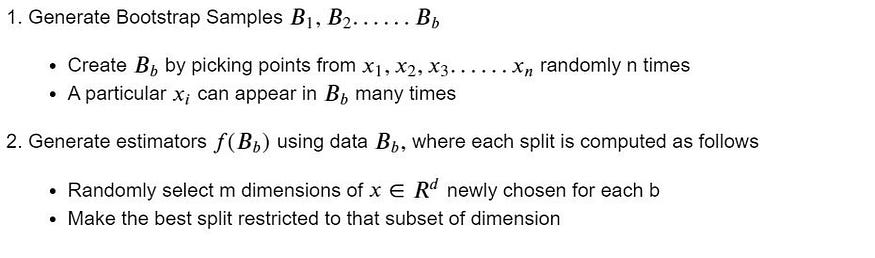

2. Algorithm

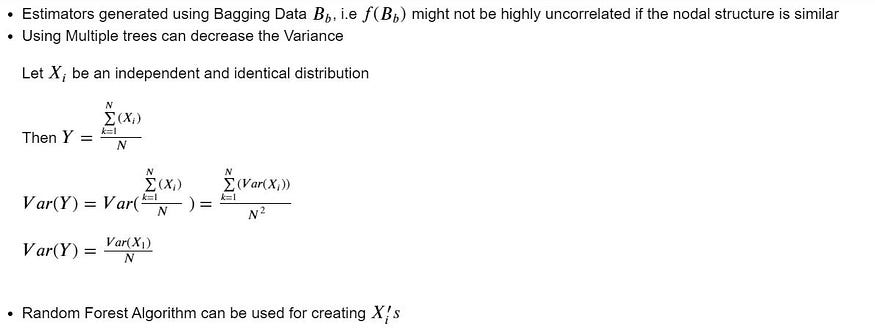

Random Forest

1. Motivation

2. Algorithm

Another advantage of Random Forest is that it does not require a holdout dataset and hence can effectively work on smaller datasets. Instead of Test Errors, we can calculate Out of Bag (OOB) Errors. The framework for this is shown below :

3. Out of Bag Error

Jupyter Lab

Here we explore data from LendingClub.com

Given many different factors including the FICO score of the borrower, the interest rate, and even the purpose of the loan, we attempt to make predictions on whether a particular loan would be paid back in full.

Why Decision Trees / Random Forests?

Decision trees are a great ‘rough and ready’ ML technique that can be applied to many different scenarios. They are intuitive, and fast, and they can deal with both numerical and categorical data. The biggest drawback of Decision Trees is their tendency to overfit the given data, resulting in errors in either variance or bias. Random forests combat this problem by employing many different Decision Trees on random samples of the data, and so are usually a more sensible choice when choosing an ML model.

Imports

import pandas as pd

import numpy as np

import seaborn as sns

import matplotlib.pyplot as plt

%matplotlib inline

Exploratory Analysis

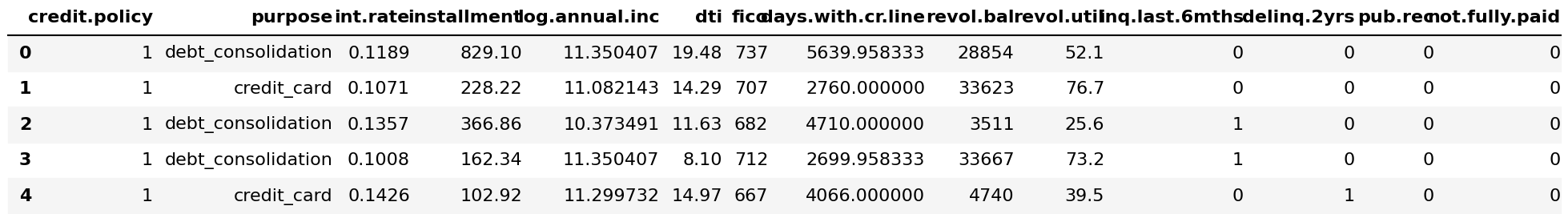

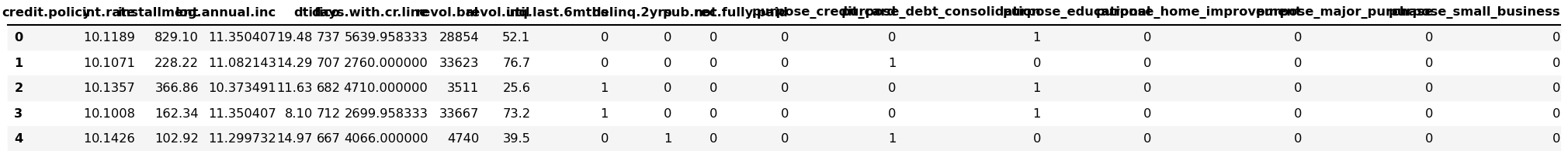

loans = pd.read_csv('loan_data.csv')loans.head()

The ‘not.fully.paid’ column is the one we are interested in predicting.

loans.info()<class 'pandas.core.frame.DataFrame'>

RangeIndex: 9578 entries, 0 to 9577

Data columns (total 14 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 credit.policy 9578 non-null int64

1 purpose 9578 non-null object

2 int.rate 9578 non-null float64

3 installment 9578 non-null float64

4 log.annual.inc 9578 non-null float64

5 dti 9578 non-null float64

6 fico 9578 non-null int64

7 days.with.cr.line 9578 non-null float64

8 revol.bal 9578 non-null int64

9 revol.util 9578 non-null float64

10 inq.last.6mths 9578 non-null int64

11 delinq.2yrs 9578 non-null int64

12 pub.rec 9578 non-null int64

13 not.fully.paid 9578 non-null int64

dtypes: float64(6), int64(7), object(1)

memory usage: 1.0+ MBloans.describe()

Some columns Information

- credit.policy: 1 if the customer meets the credit underwriting criteria of LendingClub.com, and 0 otherwise.

- purpose: The purpose of the loan (takes values “credit_card”, “debt_consolidation”, “educational”, “major_purchase”, “small_business”, and “all_other”).

- int.rate: The interest rate of the loan, as a proportion (a rate of 11% would be stored as 0.11). Borrowers judged by LendingClub.com to be riskier are assigned higher interest rates.

- installment: The monthly installments owed by the borrower if the loan is funded.

- log.annual.inc: The natural log of the self-reported annual income of the borrower.

- dti: The debt-to-income ratio of the borrower (amount of debt divided by annual income).

- fico: The FICO credit score of the borrower.

- days.with.cr.line: The number of days the borrower has had a credit line.

- revol.bal: The borrower’s revolving balance (amount unpaid at the end of the credit card billing cycle).

- revol.util: The borrower’s revolving line utilization rate (the amount of the credit line used relative to total credit available).

- inq.last.6mths: The borrower’s number of inquiries by creditors in the last 6 months.

- delinq.2yrs: The number of times the borrower had been 30+ days past due on a payment in the past 2 years.

- pub.rec: The borrower’s number of derogatory public records (bankruptcy filings, tax liens, or judgments).

Data visualization

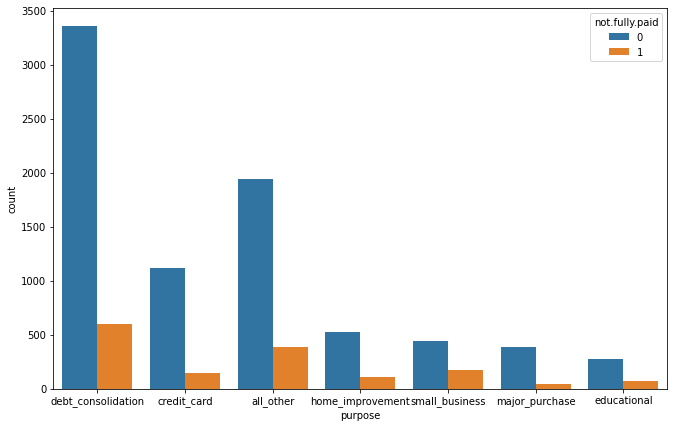

plt.figure(figsize=(11,7))

sns.countplot(loans['purpose'], hue = loans['not.fully.paid'])We split our target function with respect to the purpose for which a loan was taken.

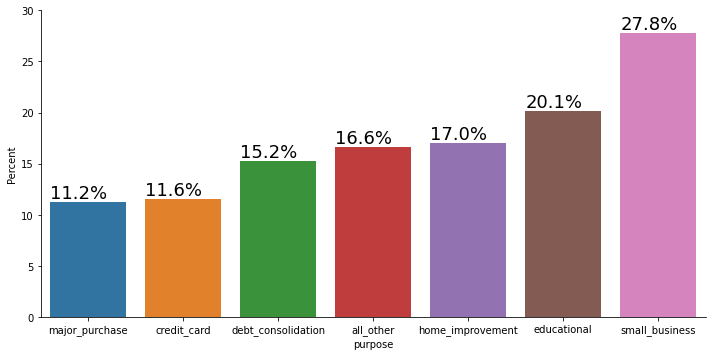

new_df = loans.groupby('purpose')['not.fully.paid'].value_counts(normalize=True)

new_df = new_df.mul(100).rename('Percent').reset_index()new_df1 = new_df[new_df["not.fully.paid"]==1]new_df1=new_df1.sort_values("Percent")g=sns.catplot(x="purpose", y='Percent', kind='bar', data=new_df1, aspect=2)

g.ax.set_ylim(0,30)

for p in g.ax.patches:

txt = str(p.get_height().round(1)) + '%'

txt_x = p.get_x()

txt_y = p.get_height()

g.ax.text(txt_x,txt_y,txt,fontsize=18,verticalalignment='bottom',multialignment='right')We would like to understand the risk as a percentage hence we look at proportion of unpaid loans in each purpose type

sns.boxplot(data =loans, x ='purpose', y= loans['int.rate']).legend().set_visible(False)Given the knowledge of risk basis purpose, we would like to understand if the APR offered to a customer take into account purpose.

df=loans

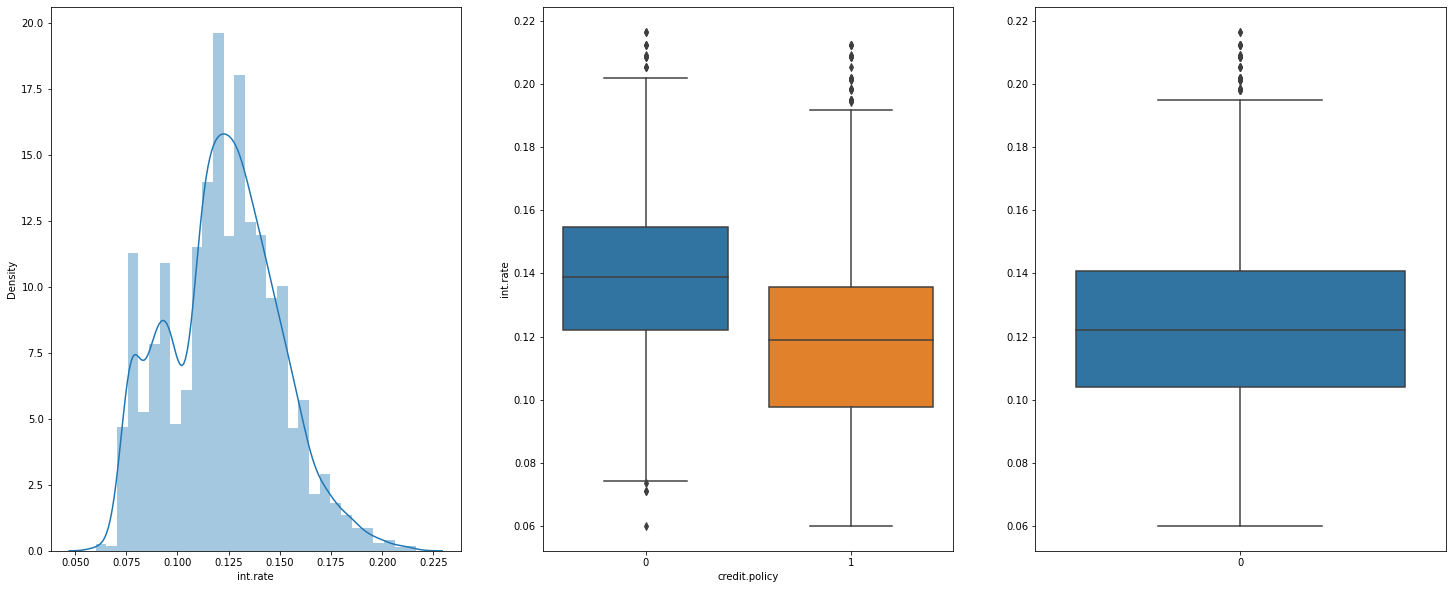

f,(ax1,ax2,ax3)= plt.subplots(1,3,figsize=(25,10))

sns.distplot(df['int.rate'], bins= 30,ax=ax1)

sns.boxplot(data =df, x ='credit.policy', y= df['int.rate'],ax=ax2).legend().set_visible(False)

sns.boxplot(data = df['int.rate'], ax=ax3)

print("Interest Rate Distribution, Credit Policy range based on the Credit policy , General Interest rate")

Interest Rate Distribution, Credit Policy range based on the Credit policy , General Interest rate

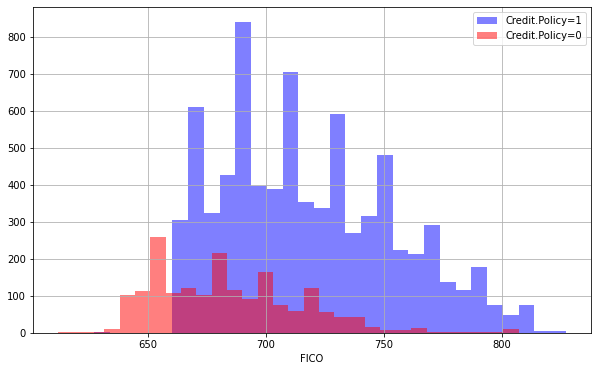

plt.figure(figsize=(10,6))

loans[loans['credit.policy']==1]['fico'].hist(alpha=0.5,color='blue',

bins=30,label='Credit.Policy=1')

loans[loans['credit.policy']==0]['fico'].hist(alpha=0.5,color='red',

bins=30,label='Credit.Policy=0')

plt.legend()

plt.xlabel('FICO')Text(0.5, 0, 'FICO')To understand if Credit Policy Underwriting from Lending Club have FICO based cut-off for applying customers, we look at the following histogram.

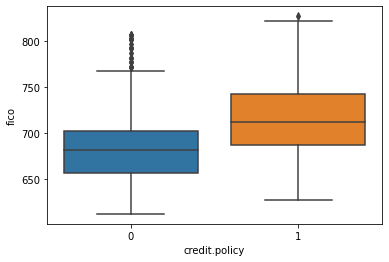

sns.boxplot(data =loans, x ='credit.policy', y= loans['fico']).legend().set_visible(False)Credit Policy promotes individuals with Higher FICO

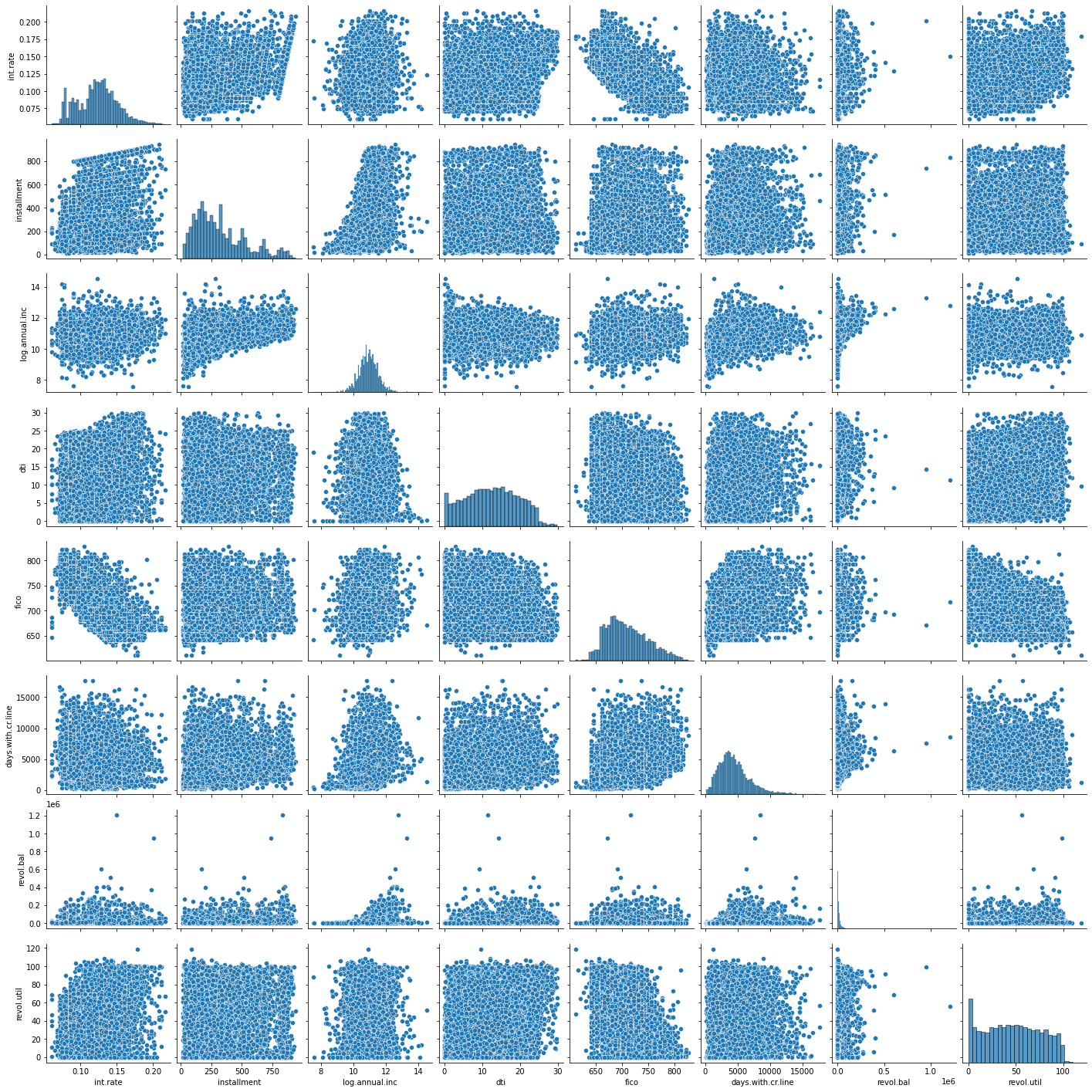

Let’s plot a seaborn pairplot between the numerical data:

sns.pairplot(loans.drop(['credit.policy', 'purpose',

'inq.last.6mths', 'delinq.2yrs', 'pub.rec', 'not.fully.paid'], axis=1))<seaborn.axisgrid.PairGrid at 0x1d9e00432c8>

Cleaning

Let’s transform the ‘purpose’ column to dummy variables so that we can include them in our analysis:

final_data = pd.get_dummies(loans,columns = ['purpose'], drop_first=True)final_data.head()

from sklearn.model_selection import train_test_splitX= final_data.drop('not.fully.paid', axis=1)

y= final_data['not.fully.paid']

X_train, X_test, y_train, y_test = train_test_split(X,y,test_size = 0.3, random_state = 101)

Decision Tree:

from sklearn.tree import DecisionTreeClassifierdtree = DecisionTreeClassifier(class_weight=None, criterion='gini', max_depth=None,

max_features=None, max_leaf_nodes=None,

min_impurity_decrease=0.0, min_impurity_split=None,

min_samples_leaf=1, min_samples_split=2,

min_weight_fraction_leaf=0.0, random_state=None,

splitter='best')dtree.fit(X_train, y_train)DecisionTreeClassifier()pred = dtree.predict(X_test)

Evaluation

np.array((pred==y_test)).sum()2104from sklearn.metrics import classification_report, confusion_matrixprint(classification_report(y_test,pred))precision recall f1-score support

0 0.86 0.82 0.84 2431

1 0.19 0.23 0.21 443

accuracy 0.73 2874

macro avg 0.52 0.53 0.53 2874

weighted avg 0.75 0.73 0.74 2874print(confusion_matrix(y_test,pred))[[2000 431]

[ 339 104]]

Random Forest:

from sklearn.ensemble import RandomForestClassifierdfor = RandomForestClassifier()dfor.fit(X_train, y_train)RandomForestClassifier()pred2 = dfor.predict(X_test)

Evaluation

(y_test == pred2).sum()2427

We can see that this has made a better prediction than a single tree

print(classification_report(y_test,pred2))precision recall f1-score support

0 0.85 0.99 0.92 2431

1 0.42 0.02 0.05 443

accuracy 0.84 2874

macro avg 0.64 0.51 0.48 2874

weighted avg 0.78 0.84 0.78 2874print(confusion_matrix(y_test,pred2))[[2416 15]

[ 432 11]]

Hyper Parameter Tuning ~ Random Forest

- n_estimators : Number of Trees in Random Forest

- max_features : Max Number of Features to be considered at each split

- max_depth : Max Depth of each estimator

- min_sample_split : Minimum Samples required for Valid Split

- min_samples_leaf : Minimum samples required at each leaf node

from sklearn.model_selection import RandomizedSearchCV

# Number of trees in random forest

n_estimators = [int(x) for x in np.linspace(start = 200, stop = 2000, num = 10)]

# Number of features to consider at every split

max_features = ['auto', 'sqrt']

# Maximum number of levels in tree

max_depth = [int(x) for x in np.linspace(10, 110, num = 11)]

max_depth.append(None)

# Minimum number of samples required to split a node

min_samples_split = [2, 5, 10]

# Minimum number of samples required at each leaf node

min_samples_leaf = [1, 2, 4]

# Create the random grid

random_grid = {'n_estimators': n_estimators,

'max_features': max_features,

'max_depth': max_depth,

'min_samples_split': min_samples_split,

'min_samples_leaf': min_samples_leaf,

}

print(random_grid){'n_estimators': [200, 400, 600, 800, 1000, 1200, 1400, 1600, 1800, 2000], 'max_features': ['auto', 'sqrt'], 'max_depth': [10, 20, 30, 40, 50, 60, 70, 80, 90, 100, 110, None], 'min_samples_split': [2, 5, 10], 'min_samples_leaf': [1, 2, 4]}

K-Fold Cross-Validation

The technique of cross-validation (CV) is best explained by example using the most common method, K-Fold CV. When we approach a machine learning problem, we make sure to split our data into a training and a testing set. In K-Fold CV, we further split our training set into K number of subsets, called folds. We then iteratively fit the model K times, each time training the data on K-1 of the folds and evaluating on the Kth fold (called the validation data).

# Use the random grid to search for best hyperparameters

# First create the base model to tune

rf = RandomForestClassifier()

# Random search of parameters, using 3 fold cross validation,

# search across 100 different combinations, and use all available cores

rf_random = RandomizedSearchCV(estimator = rf, param_distributions = random_grid, n_iter = 100, cv = 3, verbose=2, random_state=42, n_jobs = -1)

# Fit the random search model

rf_random.fit(X_train, y_train)Fitting 3 folds for each of 100 candidates, totalling 300 fits

RandomizedSearchCV(cv=3, estimator=RandomForestClassifier(), n_iter=100, n_jobs=-1,

param_distributions={'max_depth': [10, 20, 30, 40, 50, 60,

70, 80, 90, 100, 110,None], 'max_features': ['auto', 'sqrt'],

'min_samples_leaf': [1, 2, 4],

'min_samples_split': [2, 5, 10],

'n_estimators': [200, 400, 600, 800,1000, 1200, 1400, 1600,

1800, 2000]}, random_state=42, verbose=2)rf_random.best_params_{'n_estimators': 200,

'min_samples_split': 10,

'min_samples_leaf': 2,

'max_features': 'sqrt',

'max_depth': 110}

References

- https://www.kaggle.com/bdmj12/random-forest-lendingclub-project/notebook

- https://www.kaggle.com/megr25/lending-club-decision-tree-and-random-forest

- https://www.kaggle.com/megr25/lending-club-loans/version/1

- http://www.cs.columbia.edu/~amueller/comsw4995s18/schedule/

- https://medium.com/@appaloosastore/string-similarity-algorithms-compared-3f7b4d12f0ff

- https://stanford.edu/~shervine/teaching/cs-229/cheatsheet-deep-learning

- https://towardsdatascience.com/random-forests-algorithm-explained-with-a-real-life-example-and-some-python-code-affbfa5a942c

- https://www.kdnuggets.com/2017/08/machine-learning-abstracts-decision-trees.html

- Clements, J. M., Xu, D., Yousefi, N., and Efimov, D. Sequential deep learning for credit risk monitoring with tabular financial data. arXiv preprint arXiv:2012.15330, 2020

Join thousands of data leaders on the AI newsletter. Join over 80,000 subscribers and keep up to date with the latest developments in AI. From research to projects and ideas. If you are building an AI startup, an AI-related product, or a service, we invite you to consider becoming a sponsor.

Published via Towards AI

Take our 90+ lesson From Beginner to Advanced LLM Developer Certification: From choosing a project to deploying a working product this is the most comprehensive and practical LLM course out there!

Towards AI has published Building LLMs for Production—our 470+ page guide to mastering LLMs with practical projects and expert insights!

Discover Your Dream AI Career at Towards AI Jobs

Towards AI has built a jobs board tailored specifically to Machine Learning and Data Science Jobs and Skills. Our software searches for live AI jobs each hour, labels and categorises them and makes them easily searchable. Explore over 40,000 live jobs today with Towards AI Jobs!

Note: Content contains the views of the contributing authors and not Towards AI.