Customer Segmentation and Time Series Forecasting Based on Sales Data

Last Updated on October 20, 2024 by Editorial Team

Author(s): Naveen Malla

Originally published on Towards AI.

This is the third article in a 3-part series. In the first part, I covered initial exploratory data analysis steps and in the second, Customer Segmentation. You don’t have to read those before getting into this article, but they’ll give you some great insights and set you up for the more exciting stuff we’re about to cover.

Customer Segmentation and Time Series Forecasting Based on Sales Data #1/3

project that got me an ml internship

pub.towardsai.net

Customer Segmentation and Time Series Forecasting Based on Sales Data #2/3

project that got me a ml job

pub.towardsai.net

Put simply, time series forecasting is a technique used to predict future values based on historical data.

We have two options for training the forecasting model:

- Train one single model for all SKUs.

- Captures general trends and patterns in the data.

- Might not be able to capture the SKU specific patterns.

2. Train one model for each SKU.

- Captures SKU specific patterns.

- Might be computationally expensive.

💡 Let’s Revisit the Dataset

This is a typical sales dataset with different features, but since we are only interested in predicting the future sales, we can drop the rest of the columns and only keep the necessary ones.

df = pd.read_csv('data/sales.csv')

df = df.drop(['order_number', 'customer_number', 'type', 'month', 'category', 'revenue', 'customer_source', 'order_source'], axis=1)

df['order_date'] = pd.to_datetime(df['order_date'])

df['day'] = df['order_date'].dt.date

df.head()

In our case, I chose to consider the second option and build a model for each product.

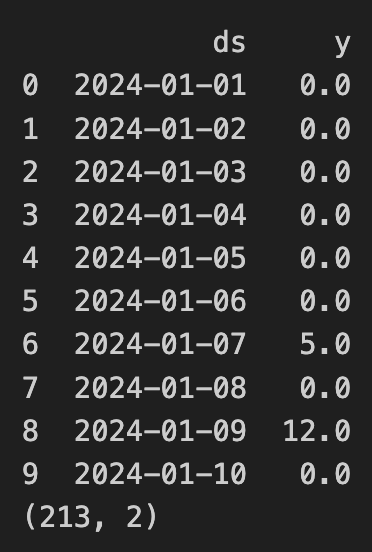

df_ke0001 = df[df[‘item_number’] == ‘KE0001’]

df_ke0001 = df_ke0001.groupby(‘day’).agg({‘quantity’:’sum’}).reset_index()

df_ke0001.columns = [‘ds’, ‘y’]

print(df_ke0001.head(10))

print(df_ke0001.shape)

y is total quantity of the product KE0001 sold on given date. We can observe that the data is not continuous, the product is not bought every so we need to fill in the missing days with 0 sales.

from datetime import date, timedelta

start_date = date(2024, 1, 1)

end_date = date(2024, 7, 31)

delta = timedelta(days=1)

days = []

while start_date <= end_date:

days.append(start_date)

start_date += delta

df_ke0001 = df_ke0001.set_index('ds').reindex(days).reset_index()

df_ke0001['y'] = df_ke0001['y'].fillna(0)

df_ke0001.columns = ['ds', 'y']

print(df_ke0001.head(10))

print(df_ke0001.shape)

Plot the sales for KE0001

plt.figure(figsize=(15, 6))

plt.plot(df_ke0001[‘ds’], df_ke0001[‘y’])

plt.title(‘Daily sales of KE0001’)

plt.show()

🎯 Stationary or Non-Stationary Data?

Stationary data:

- The statistical properties of the data like mean do not change over time. Or at least not so much.

- Time series models usually work better with stationary data.

How to check if the data is stationary?

- We use the Augmented Dickey-Fuller test.

- This test checks if the properties of data like mean and standard deviaton are constant over time.

Augmented Dickey-Fuller test gives us two values.

1) p-value: If less than 0.05, the data is stationary.

2) ADF Statistic: The more negative this value, the stronger the evidence that the data is stationary.

from statsmodels.tsa.stattools import adfuller

result = adfuller(df_ke0001['y'])

print(f'ADF Statistic: {result[0]}')

print(f'p-value: {result[1]}')

- The ADF Statistic is far less than 0 and the p-value is far less than 0.05.

- Safe to say the data is stationary.

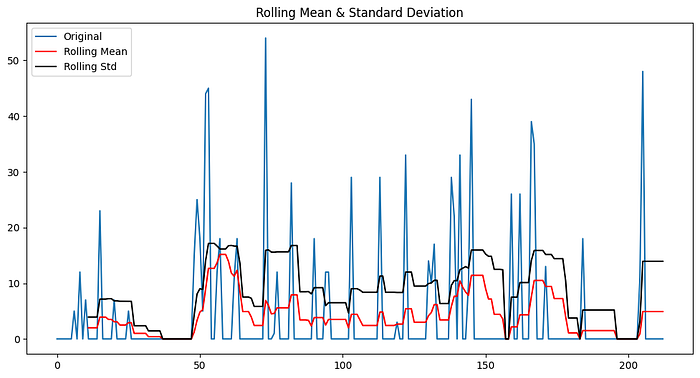

📉 Rolling Mean and Rolling Standard Deviation

- Yet another way to make sure the data is stationary.

- These metrics calculate the mean and strandard deviation continuously over a window of time.

rolmean = df_ke0001[‘y’].rolling(window=12).mean()

rolstd = df_ke0001[‘y’].rolling(window=12).std()

plt.figure(figsize=(12, 6))

plt.plot(df_ke0001['y'], label='Original')

plt.plot(rolmean, color='red', label='Rolling Mean')

plt.plot(rolstd, color='black', label='Rolling Std')

plt.title('Rolling Mean & Standard Deviation')

plt.legend()

plt.show()

In our case…

- There are fluctuations in the data due to the high spikes in the sales.

- But the overall trend seems to be stationary. Not moving up or down.

📊 Different Models That Can Be Used for Time Series Forecasting

- ARIMA (AutoRegressive Integrated Moving Average):

Best for: Non-seasonal data without trends. - SARIMA (Seasonal ARIMA):

Best for: Seasonal data with patterns that repeat at regular intervals. - Prophet:

Best for: Handling seasonality, holidays, and missing data. - LSTM (Long Short Term Memory):

Best for: Complex data with long-term dependencies.

- Missing data is a key factor for us here because we have many days where there are no sales. So we choose Prophet.

- Analysis and Results with ARIMA in APPENDIX for further reading.

About Prophet

- Developed by Researchers at Facebook.

- Decomposes time series into trend, seasonality, and holidays.

- Handles missing data.

- Automatically detects change points in the time series.

Let’s train the model and make the data frame ready for accommodating sales for next 3 months.

# train the model

from prophet import Prophet

model = Prophet(interval_width=0.95)

model.add_seasonality(name='monthly', period=30.5, fourier_order=10)

model.fit(df_ke0001)

future_dates = model.make_future_dataframe(periods=90, freq='D')

future_dates.tail()

Get the forecast

forecast = model.predict(future_dates)

# Clip the forecasted values to be zero or above

forecast['yhat'] = forecast['yhat'].clip(lower=0)

forecast['yhat_lower'] = forecast['yhat_lower'].clip(lower=0)

forecast['yhat_upper'] = forecast['yhat_upper'].clip(lower=0)

forecast[['ds', 'yhat', 'yhat_lower', 'yhat_upper']].tail()

Here…

- yhat: Forecasted value for the target variable.

- yhat_lower: Lower bound of the forecast (clipped to 0 in this case).

- yhat_upper: Upper bound of the forecast, showing the highest possible value.

🔮 Analysing various trends in the data.

model.plot_components(forecast);

Understanding the y-axis:

- The y-axis in these plots represents the contribution of each component (trend, weekly seasonality, monthly seasonality) to the overall forecast.

- For example, a value of -2 on Monday indicates that Mondays typically see 2 units fewer than the baseline trend

Observations:

- Trend Plot: Reflects a slow and steady increase in the data over time, as indicated by the slight upward slope.

- Weekly Seasonality Plot: Shows how different days of the week affect the data, with some days (like Saturdays) showing higher activity than others (like Mondays).

- Monthly Seasonality Plot: Reveals specific days in the month that have significant impact on the sales, such as around the middle of the month.

📈 Time for the Forecast

# Ensure both are in datetime format

df_ke0001[‘ds’] = pd.to_datetime(df_ke0001[‘ds’])

# Filter out the historical period from the forecast

forecast_filtered = forecast[forecast['ds'] > df_ke0001['ds'].max()]

# Plot only future forecasts

plt.figure(figsize=(15, 6))

plt.plot(df_ke0001['ds'], df_ke0001['y'], label='Original Data')

plt.plot(forecast_filtered['ds'], forecast_filtered['yhat'], label='Forecast', linestyle=' - ')

plt.fill_between(forecast_filtered['ds'], forecast_filtered['yhat_lower'], forecast_filtered['yhat_upper'], color='blue', alpha=0.2, label='Uncertainty Interval')

plt.title('Comparison of Original Data and Future Forecast')

plt.legend()

plt.show()

Forecast Overview:

- The forcast captures the general trend and presence of spikes but doesn’t fully replicate the spike patterns because it might see them as irregular.

- Prophet model can efficiently capture seasonality and trends but might miss specific, irregular spikes.

🛠 How to make it better?

More accurate predictions could be achieved by adding information like promotions, holidays, or other significant events that might influence sales.

Now we forecast for all individual items in the dataset for the next 90 days.

- We get all the unique items.

- Then, iterate over to train, forecast and save the forcasted data for each item.

unique_items = df[‘item_number’].unique()

print(unique_items.shape)

print(unique_items[:5])

We basically build 1000 small models, each for a different item and get the individual forecasts.

import pandas as pd

from prophet import Prophet

# Create a new DataFrame to store the forecasted data

forecasted_data = pd.DataFrame(columns=['item_number', 'August', 'September', 'October'])

# Loop through all the unique items

for item in unique_items:

df_item = df[df['item_number'] == item]

df_item = df_item.groupby('day').agg({'quantity': 'sum'}).reset_index()

df_item.columns = ['ds', 'y']

# Fill in the missing days

df_item = df_item.set_index('ds').reindex(days).reset_index()

df_item['y'] = df_item['y'].fillna(0)

# Train the model

model = Prophet(interval_width=0.95)

model.add_seasonality(name='monthly', period=30.5, fourier_order=10)

model.fit(df_item)

# Forecast the next 90 days

future_dates = model.make_future_dataframe(periods=90, freq='D')

forecast = model.predict(future_dates)

# Clip the forecasted values to be zero or above

forecast['yhat'] = forecast['yhat'].clip(lower=0)

forecast['yhat_lower'] = forecast['yhat_lower'].clip(lower=0)

forecast['yhat_upper'] = forecast['yhat_upper'].clip(lower=0)

# Save the forecasted data

august_sum = forecast['yhat'].iloc[212:243].sum()

september_sum = forecast['yhat'].iloc[243:273].sum()

october_sum = forecast['yhat'].iloc[273:304].sum()

# Create a DataFrame for the current item

forecasted_item = pd.DataFrame({

'item_number': [item],

'August': [august_sum],

'September': [september_sum],

'October': [october_sum],

'Total': [august_sum + september_sum + october_sum]

})

# Use pd.concat() to append the data

forecasted_data = pd.concat([forecasted_data, forecasted_item], ignore_index=True)

# Display the forecasted data

print(forecasted_data.head(10))

# save the forecasted data in a csv file

forecasted_data.to_csv('data/forecasted_data.csv', index=False)Get the top 100 products in the original data and forecasted data and see how many match.

Almost half of the top 100 products in the original data match with the forecasted data.

Next, let’s compare the total sales of the top 10 products in the original data and forecasted data.

Observation:

The predictions show an increase in sales in next three months, following the slight increase of trend in the original data as seen in the first part where we did EDA.

I also created two models trained on weekly sales and daily sales using ARIMA. I put that code and explanation in Appendix section of the notebook so as to not make this too long.

Star the repo for further/future reference here:

GitHub – naveen-malla/Customer-Segmentation-and-SKU-Forecasting: This repo contains code for…

This repo contains code for performing customer segmentation and sales forecast prediction on a company's sales data. …

github.com

If you found the post informative, please

- hold the clap button for a few seconds (it goes up to 50) and

- follow me for more updates.

It gives me the motivation to keep going and helps the story reach more people like you. I share stories every week about machine learning concepts and tutorials on interesting projects. See you next week. Happy learning!

Connect with me: LinkedIn, Medium, GitHub

Join thousands of data leaders on the AI newsletter. Join over 80,000 subscribers and keep up to date with the latest developments in AI. From research to projects and ideas. If you are building an AI startup, an AI-related product, or a service, we invite you to consider becoming a sponsor.

Published via Towards AI

Take our 90+ lesson From Beginner to Advanced LLM Developer Certification: From choosing a project to deploying a working product this is the most comprehensive and practical LLM course out there!

Towards AI has published Building LLMs for Production—our 470+ page guide to mastering LLMs with practical projects and expert insights!

Discover Your Dream AI Career at Towards AI Jobs

Towards AI has built a jobs board tailored specifically to Machine Learning and Data Science Jobs and Skills. Our software searches for live AI jobs each hour, labels and categorises them and makes them easily searchable. Explore over 40,000 live jobs today with Towards AI Jobs!

Note: Content contains the views of the contributing authors and not Towards AI.